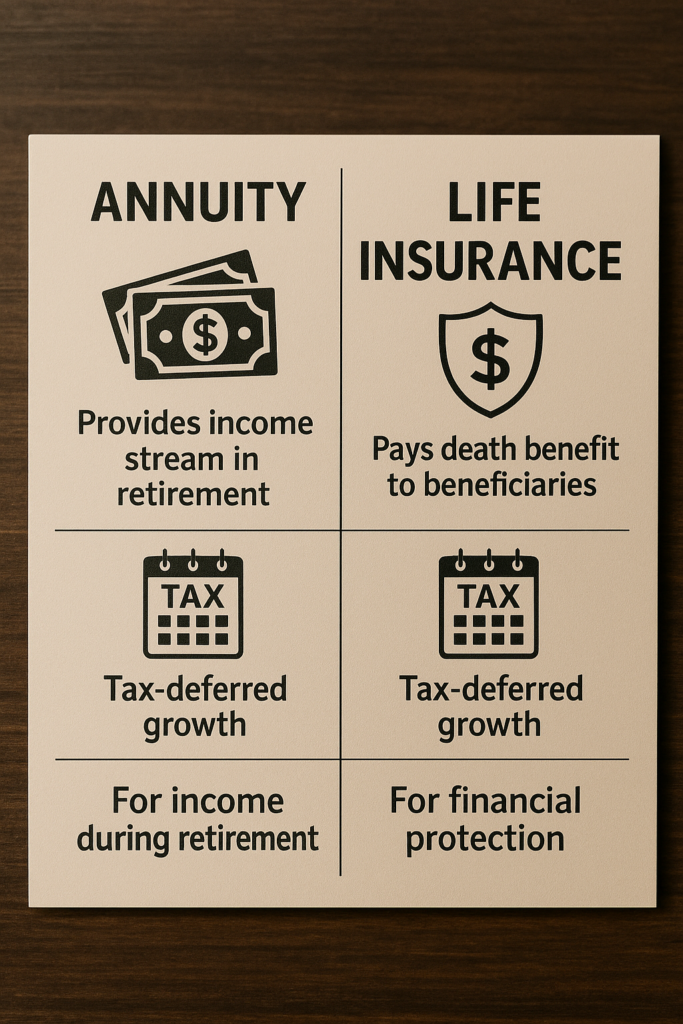

When planning your financial future, annuities and life insurance often surface as popular options—but they serve very different purposes. While both are offered by insurance companies and can play important roles in a retirement strategy, understanding their unique features and goals is essential before committing your hard-earned money.

Table of Contents

Defining the Basics

Life insurance primarily provides a death benefit to your beneficiaries if you pass away during the policy term or lifetime of the contract. It helps replace lost income, cover final expenses, and protect loved ones from financial hardship.

In contrast, an annuity is designed to generate a series of future payments—typically during retirement—in exchange for an upfront premium or series of premium payments. Annuities focus on income accumulation and distribution rather than death benefits.

How Death Benefits and Income Streams Differ

Life insurance policies like term or whole life guarantee a payout to beneficiaries upon death. There’s no built-in mechanism for creating retirement income, and any cash value accumulation in permanent policies is secondary to the death benefit.

Annuities reverse this structure. For example, the New York Life Premier Variable Annuity II lets you invest in market-linked options while offering a lifetime income cushion with built-in features such as death benefit guarantees and optional living benefits to protect against market downturns. The primary goal is ensuring you don’t outlive your savings.

Accumulation Phase vs. Protection Phase

With life insurance, any cash value growth occurs during the protection phase, serving as an emergency reserve you can borrow against. Policy loans may reduce the death benefit if not repaid.

Annuities, however, enter an accumulation phase where your premium earns interest—either at a fixed rate, linked to a market index, or through mutual fund–style investment options. Fixed annuities such as the Brighthouse Shield MYGA 3-Year Annuity guarantee a set rate for three years, making them ideal for conservative savers seeking predictable growth.

Tax Treatment and Timing

Both tools offer tax advantages but in different ways. Life insurance cash value grows tax deferred, and death benefits are generally paid tax free to beneficiaries. By comparison, annuities also grow tax deferred, but withdrawals are taxed as ordinary income upon distribution.

Timing matters: life insurance serves throughout your earning years, while annuities are tailored for retirement. A retirement annuity acts as a personal pension plan, converting your savings into a steady, often guaranteed, income stream that supplements Social Security and other retirement assets.

Customizing for Your Needs

Modern annuities allow riders and optional benefits to match individual goals:

- Lifetime income riders guarantee you cannot outlive your funds.

- Death benefit riders ensure remaining account value passes to heirs.

- Long-term care riders may cover extended healthcare costs.

Similarly, life insurance policies offer variations:

- Term life for temporary coverage at lower premiums.

- Whole life for lifetime protection with cash value growth.

- Universal life for flexible premiums and death benefits.

If you’re evaluating a New York Life annuity option focused on lifetime income, consider the New York Life Guaranteed Lifetime Income Annuity II, which provides a predictable payout based on your needs and life expectancy.

Which One Suits You?

- Consider life insurance if your priority is protecting dependents and covering final expenses.

- Consider annuities if your focus is securing predictable income for retirement and managing longevity risk.

In many cases, a balanced plan may include both: life insurance during your working years to safeguard your family, then annuities in retirement to ensure consistent cash flow.

Next Steps

Deciding between life insurance and annuities can feel overwhelming. For clear, unbiased reviews of top annuity products—ranging from fixed options like the Brighthouse Shield MYGA to variable solutions such as the New York Life Premier Variable Annuity II—visit Annuity Gator. Their independent analysis helps you compare features, fees, and guarantees so you can build a retirement strategy that provides both protection and peace of mind.